You can earn 6% cash back on everyday purchases with today’s Highest Cash Back Credit Cards . These cards help you save hundreds of dollars when you shop for groceries or eat at restaurants.

Most credit cards give you just 1-2% back. The Blue Cash Preferred® Card from American Express stands out by offering 6% cash back at U.S. supermarkets (up to $6,000 per year). Several cards reward you with 5% back in rotating categories, 4% on dining, and maybe even 8% on entertainment purchases.

We analyzed more than 400 credit cards to find the best cash-back options for 2025. The right card should match how you spend money, and we can help you pick the perfect one.

Blue Cash Preferred Credit Card: 6% at U.S. Supermarkets

The Blue Cash Preferred Card offers an impressive 6% cash back at U.S. supermarkets. This rate makes it a valuable choice, especially when you have significant grocery expenses.

Blue Cash Preferred Credit Card Features and Benefits

Cardholders can earn 6% cash back at U.S. supermarkets up to $6,000 in annual purchases. The card also offers 6% back on select U.S. streaming subscriptions, 3% at U.S. gas stations, and 3% on transit payments. You can redeem your cash back as reward dollars through statement credits or at Amazon.com checkout.

How to Maximize the 6% Grocery Rewards

You can earn maximum returns by using your card at qualifying U.S. supermarkets. Here’s what qualifies:

- Grocery items and fresh produce

- Cleaning supplies and health products

- Bakery items and prepared foods

- Floral arrangements and party supplies

The 6% rate doesn’t apply to warehouse clubs, superstores like Target and Walmart, or specialty food stores.

Annual Fee vs Rewards Analysis

Your first year comes with no annual fee, followed by $95 yearly. You can cover the annual fee by spending just $31 weekly at supermarkets. The $6,000 grocery limit can earn you $360 in cash back annually. So, spending $1,583 or more yearly at supermarkets will offset the fee through grocery rewards alone.

Spending Caps and Limitations

The 6% supermarket reward applies to your first $6,000 in annual purchases, then drops to 1%. Large families might find this cap restrictive since it averages $500 monthly in grocery spending. Notwithstanding that, you can earn unlimited 6% back on eligible U.S. streaming services without spending restrictions.

Citi Custom Cash Card: 5% on Top Spending Category

The Citi Custom Cash Card makes earning rewards simple. Your 5% cash back category adjusts automatically based on your spending patterns. You won’t need to track or activate bonus categories each billing cycle.

Automatic Category Selection Benefits

The card’s smart system tracks your purchases and gives you 5% cash back in your highest spending category each billing cycle. This removes the hassle of picking categories or timing your purchases. Your rewards adjust as your spending habits change, so you’ll always get the most cash back where you spend the most.

Eligible 5% Categories

The card gives you 5% cash back in a variety of spending categories:

- Restaurants and dining establishments

- Gas stations

- Grocery stores

- Select travel and transit services

- Select streaming platforms

- Drugstores

- Home improvement stores

- Fitness clubs

- Live entertainment venues

- Select transit options

The travel category covers airlines, hotels, and cruise lines while streaming services include popular platforms like Netflix, Disney+, and Spotify. The card also gives you an extra 4% cash back on hotels, car rentals, and attractions booked through the Citi Travel portal through June 30, 2026.

Monthly Spending Caps

You’ll earn 5% cash back on the first USD 500 spent in your top category each billing cycle. Purchases beyond this amount earn 1% cash back. This structure lets you earn up to USD 25 in bonus cash back monthly, which could add up to USD 300 annually if maximized. Every other purchase outside your top category earns 1% cash back consistently.

Chase Freedom Flex: 5% Rotating Categories

The Chase Freedom Flex shines with its dynamic 5% cash-back program. The program updates every quarter to provide cardholders with fresh earning opportunities throughout the year.

Quarterly Bonus Categories

Q1 2025 (January through March) lets cardholders earn 5% cash back in these categories:

- Grocery stores (excluding Walmart® and Target®)

- Norwegian Cruise Line® bookings

- Fitness clubs and gym memberships

- Hair, nails, and spa services

Chase reveals new categories about two weeks before each quarter starts. This rotation helps members get the most rewards from different spending categories year-round.

Category Activation Requirements

Members need to activate their bonus categories to earn the 5% cash-back rate. Q1 2025’s activation window started December 16, 2024, and continues through March 14, 2025. The bonus rate applies to all eligible purchases made since the quarter’s beginning once activated.

Members can activate their categories through several methods:

- Chase’s website or mobile app

- Email activation link

- Phone Activation

- In-person at Chase branches

- Chase ATMs (for checking customers)

Maximum Earning Potential

The 5% bonus rate covers the first $1,500 in combined purchases from all active bonus categories each quarter. Members can earn up to $75 in cash back per quarter, which adds up to $300 yearly when they maximize each quarter’s categories.

Rewards come as Chase Ultimate Rewards points, and each dollar spent in bonus categories earns 5 points. Purchases in bonus categories earn 1% cash back after reaching the quarterly spending cap.

Smart spending is key with this card. Purchases must be completed and processed by the merchant before the quarter ends to get the 5% rate. Physical locations like fitness clubs qualify only for in-person memberships – digital subscriptions do not earn the bonus rate.

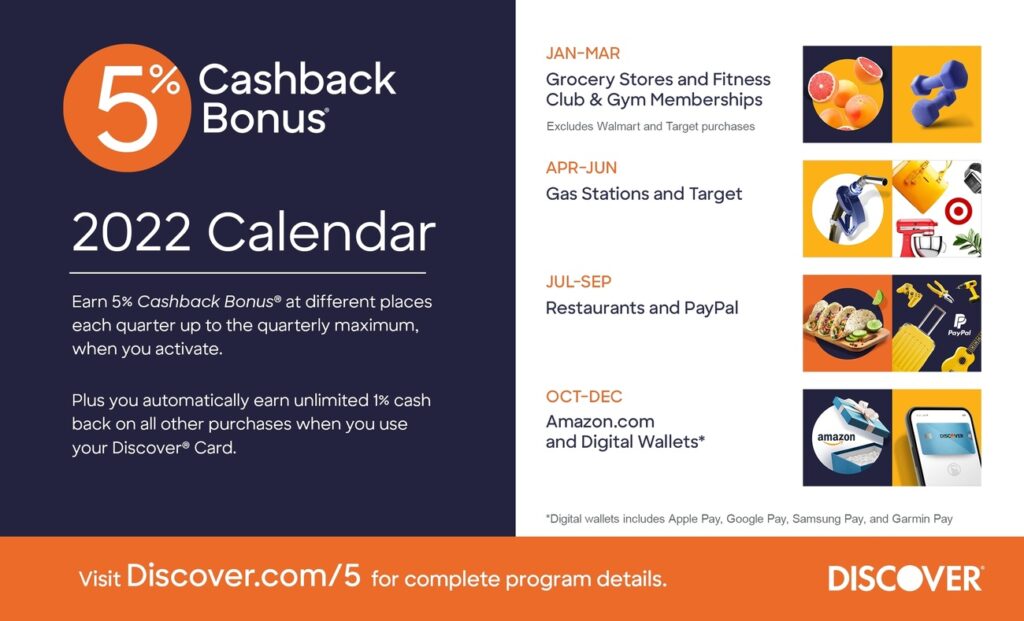

Discover it Cash Back: 5% Quarterly Categories.

Discover’s rotating rewards program makes it easy to maximize cash back earnings with quarterly category changes. New cardholders get automatic reward matching.

Cash Back Calendar Overview

Q1 2025 (January through March) lets cardholders earn 5% cash back in three categories:

- Restaurants and dining establishments

- Home improvement stores (online and in-store)

- Select streaming services

Cardholders need to activate these bonus categories through their online account, mobile app, or by calling Discover. The 5% rate kicks in for qualifying purchases after activation during that quarter.

First-Year Cash Back Match

Discover doubles all cash back earned in your first year automatically. You’ll get $600 if you earn $300 in rewards. The match amount has no limit, and your redemptions throughout the year won’t affect the final match.

Quarterly Rewards Caps

The 5% bonus applies to your first $1,500 in combined quarterly spending across active categories. Purchases beyond this limit still earn 1% cashback. Smart cardholders can earn up to $75 in bonus cash back each quarter by maximizing these spending limits.

Merchant category codes determine which purchases qualify for bonus rewards. Streaming services that qualify include popular platforms like Netflix, Amazon Prime Video, Disney+, and YouTube TV. Restaurant rewards apply to full-service establishments, cafes, and fast-food locations, including eligible takeout services.

Your rewards come with flexible redemption options. You can choose statement credits, direct deposits, Amazon.com purchases, or gift cards starting at $5. Your cashback stays valid as long as your account remains active.

Amazon Prime Rewards Visa: 5% at Amazon One Of The 10 Highest Cash Back Credit Cards

The Prime Visa rewards dedicated Amazon shoppers with its signature 5% cash-back program. This card is a perfect fit for regular Amazon customers and offers rewards well beyond Amazon purchases.

Prime Membership Requirements

A cardholder’s first need is an active Amazon Prime membership at $139 annually or $14.99 monthly. Students can get discounted rates at $69 annually, and EBT and Medicare recipients pay reduced pricing at $84 per year. New card members get a $100 Amazon Gift Card added to their account right after approval.

Amazon Purchase Eligibility

The 5% cash back rate applies to:

- Amazon.com purchases (including digital downloads and gift cards)

- Amazon Fresh orders

- Whole Foods Market purchases

- Chase Travel bookings

The card lets you earn 10% back or more on rotating selections of items and categories on Amazon.com. Each 100 points equals $1.00 when redeemed at Amazon.com or through Chase.

Additional Earning Categories

The card’s rewards extend beyond Amazon purchases with a tiered structure:

- 2% cash back at gas stations and restaurants

- 2% back on local transit and commuting, including rideshare services

- 1% back on all other purchases

There are no point maximums or earning limits on this card. Rewards keep adding up as long as your account stays in good standing. Your points never expire while the card account remains active. You can redeem cash rewards back, gift cards, or travel through Chase.com, though some options have minimum redemption amounts.

Capital One Savor: 4% on Dining and Entertainment

The Capital One Savor card’s rewards structure makes it a great choice for food lovers and people who enjoy going out. You can earn 3% cash back when you spend money on dining, entertainment, popular streaming services, and grocery store purchases.

Restaurant and Entertainment Coverage

The dining rewards include many different places. You can earn rewards at restaurants, cafes, bars, lounges, fast-food chains, and bakeries. The entertainment rewards are pretty extensive too. You’ll earn cash back when you buy tickets at:

- Movie theaters and theatrical venues

- Professional and semi-professional sporting events

- Amusement parks and tourist attractions

- Aquariums, zoos, and dance halls

- Record stores, pool halls, and bowling alleys

You can boost your earnings to 8% cash back when you make purchases through Capital One Entertainment. This special portal lets you access exclusive events, and you can get cardholder-only reservations at award-winning restaurants and unique food experiences.

Streaming Service Rewards

Right now, you’ll earn 3% cash back on eligible streaming platforms. Netflix, Hulu, Disney+, and Max (formerly HBO Max) are some of the services that qualify. But Prime Video, AT&T TV, Verizon Fios On Demand, and fitness programming don’t earn bonus rewards.

Annual Fee Considerations

The best part? The Capital One Savor has no annual fee. This makes it perfect if you want premium dining and entertainment rewards. You can maximize your earnings without worrying about a yearly charge.

The card sometimes runs special deals like 5% cash back on hotels and rental cars booked through Capital One Travel. Plus, you’ll get access to exclusive dining experiences through Capital One Dining, with special reservations available at 400 top restaurants across the United States.

U.S. Bank Cash+: Choose Your 5% Categories

The U.S. Bank Cash+ Visa Signature Card gives you control by letting you customize 5% cash back categories based on your spending habits. You can select bonus categories that fit your lifestyle perfectly.

Category Selection Process

You can select your categories 45 days before each quarter starts. We selected the U.S. Bank Rewards Center as the platform for cardholders to choose their categories. Here’s how to activate your selections:

- Sign in to your U.S. Bank account

- Click “View Rewards” on the dashboard

- Select “Redeem Rewards”

- Choose your preferred categories

Your earnings start from day one if you make selections five or more days before the quarter begins. The rewards take effect within three business days otherwise.

Available 5% Options

You can pick two categories from these twelve options to earn 5% cash back:

- Fast food establishments

- Home Utilities

- TV, internet, and streaming services

- Department stores

- Cell phone providers

- Electronic stores

- Sporting goods stores

- Movie theaters

- Gyms and fitness centers

- Furniture Stores

- Ground Transportation

- Select clothing stores

The card lets you pick one 2% category from options like gas stations, grocery stores, or restaurants.

Quarterly Maximum Earnings

Your 5% cash back applies to the first $2,000 in combined eligible purchases each quarter from your two chosen categories. This structure helps you earn up to $400 in bonus rewards each year by maximizing your quarterly spending.

The card also gives you 5% cash back on prepaid air, hotel, and car reservations booked through the Rewards Travel Center. This benefit has no spending cap, which makes it perfect for travelers who like to plan.

American Express Gold Card: 4% at Restaurants

The American Express Gold Card takes dining rewards to another level with its 4X points structure at restaurants worldwide. This card shines with its global coverage and flexible reward options.

Dining Rewards Structure

You’ll earn 4X Membership Rewards® points for every dollar spent at restaurants worldwide. This includes takeout and delivery in the U.S., with a $50,000 annual purchase limit. The rewards cover everything from your morning coffee to fancy dinner outings. Your purchases will earn one point per dollar after reaching the yearly limit.

Statement Credits and Benefits

The card comes packed with several dining-related credits throughout the year:

- $120 Dining Credit: Monthly $10 statement credits for purchases at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys

- $120 Uber Cash: $10 monthly for Uber Eats orders and Uber rides in the U.S.

- $100 Resy Credit: Biannual $50 credits for dining at U.S. Resy restaurants

- $84 Dunkin’ Credit: Monthly $7 statement credits for U.S. Dunkin’ purchases

You’ll need to enroll for these credits through your card account. The dining credit works every month, and unused credits don’t roll over to the next month.

Points Valuation for Cash Back

Membership Rewards® points give you flexible redemption choices. You can transfer points to 19 airline and hotel partners, which gives better value than direct cash back. Point values range from 1 cent for direct travel bookings to 1.2 cents through transfer partners.

A $100 restaurant bill will earn you 400 points if you prefer cash back. These points convert to about $2.40 in cash back value. The card has a $325 annual fee, but regular restaurant-goers can offset this cost by a lot through dining credits and rewards.

Venmo Credit Card: Up to 3% Top Category

The Venmo Credit Card turns your everyday spending into rewards with its smart 3-2-1% cash back structure that adjusts to how you spend money. You won’t pay an annual fee, and the card excels at optimizing rewards in eight different spending categories.

Automatic Category Selection

The card’s smart system keeps track of your purchases and gives you 3% cash back in whatever category you spend the most each statement period. Your second-highest spending category gets you 2% cash back, and everything else, including Venmo person-to-person transactions, earns 1%. You don’t need to activate or pick categories yourself – it all happens automatically.

Monthly Reward Calculations

The card rewards you in these spending categories:

- Travel and Transportation

- Grocery stores

- Bills and utilities

- Health and beauty

- Gas

- Entertainment

- Dining and nightlife

- Streaming services

Your rewards move to your Venmo balance within 1-3 days after your statement closes. You can also set up your cashback to buy crypto automatically, choosing from Bitcoin, Litecoin, Bitcoin Cash, or Ethereum with no transaction fees.

Venmo Integration Benefits

The card naturally works with the Venmo app and gives you unique ways to handle expenses. Your physical card has a QR code on the front that makes splitting purchases with friends quick and easy. Anyone can scan this code through the Venmo app to send or request money right away.

The app shows you transactions and reward activity as they happen, and you can pay bills too. Your cashback can be used for:

- Credit card bill payments

- Purchases through merchants accepting Venmo

- Transfers to linked bank accounts or debit cards

- Person-to-person payments within the app

This detailed integration makes the Venmo Credit Card especially useful when you have to split expenses often or want to manage your money through one platform.

Wells Fargo Active Cash: 2% on Everything

The Wells Fargo Active Cash card is both simple and powerful, giving you unlimited 2% cash rewards on purchases without category restrictions or activation requirements. You won’t have to deal with tracking bonus categories or quarterly activations.

Flat-Rate Rewards Structure

You’ll earn 2% cash rewards consistently throughout the year on eligible purchases. Most transactions qualify for rewards, though you won’t earn points on balance transfers, cash equivalents, lottery tickets, and casino chips. New cardholders can get a $200 cash rewards bonus by spending $500 in the first three months.

Additional Card Benefits

The card’s protection features are impressive, especially its cell phone coverage. Your monthly wireless bill payment with the card gets you up to $600 protection per claim against damage or theft. You can make two claims every 12 months with a $25 deductible.

The card also gives you access to:

- Visa Signature Concierge services available 24/7

- Travel and emergency assistance

- Auto rental collision coverage up to $50,000

- Zero liability protection for unauthorized transactions

Cash Back Redemption Options

You can redeem rewards on your Wells Fargo Active Cash card starting at just $1. The card lets you redeem rewards through:

- Statement credits to offset purchases

- Direct deposits into Wells Fargo checking or savings accounts

- ATM withdrawals in $20 increments using a Wells Fargo debit card

- Gift cards in various denominations

- PayPal purchases at participating merchants

The card has a $0 annual fee and comes with a 0% intro APR on purchases and qualifying balance transfers for 12 months from account opening. After that, a variable APR of 19.24%, 24.24%, or 29.24% kicks in. The mix of steady rewards and useful benefits makes this card perfect for everyday spending without complicated category restrictions.

Comparison Table

| Credit Card | Primary Cash Back Rate | Annual Fee | Spending Cap | Key Benefits | Redemption Options |

| Blue Cash Preferred | 6% at U.S. supermarkets | $95 (waived first year) | $6,000/year for supermarkets | 6% on U.S. streaming, 3% gas stations & Transit | Statement credits, Amazon checkout |

| Citi Custom Cash | 5% on top spending category | Not mentioned | $500/month in top category | Automatic category adjustment, 10 eligible categories | Not mentioned |

| Chase Freedom Flex | 5% rotating categories | Not mentioned | $1,500/quarter | Retroactive rewards once activated, Multiple activation methods | Chase Ultimate Rewards points |

| Discover it Cash Back | 5% quarterly categories | Not mentioned | $1,500/quarter | First-year cash back match, No limit on match amount | Statement credits, direct deposits, Amazon, gift cards |

| Amazon Prime Rewards Visa | 5% at Amazon & Whole Foods | Requires Prime ($139/year) | No cap mentioned | $100 Amazon Gift Card bonus, 10%+ on select items | Cashback, Amazon purchases, gift cards, travel |

| Capital One Savor | 4% dining & entertainment | $0 | Not mentioned | 8% on Capital One Entertainment, Access to exclusive dining experiences | Not mentioned |

| U.S. Bank Cash+ | 5% on two chosen categories | Not mentioned | $2,000/quarter | Choice of 12 categories, Additional 2% category selection | Not mentioned |

| American Express Gold | 4X points at restaurants | $325 | $50,000/year | $120 dining credit, $120 Uber Cash, $100 Resy credit | Points transfer to partners, travel booking |

| Venmo Credit Card | Up to 3% top category | Not mentioned | Not mentioned | Automatic category optimization, QR code splitting | Venmo balance, crypto, bank transfers |

| Wells Fargo Active Cash | 2% on everything | $0 | Unlimited | $200 bonus offer, Cell phone protection up to $600 | Statement credits, direct deposits, ATM withdrawals, gift cards |

Conclusion

Your spending habits and lifestyle priorities play a big role in picking the perfect cash-back credit card. The best cards can earn you 3-6% back on everyday purchases instead of the basic 1-2% rewards.

The Blue Cash Preferred shines with grocery rewards. The Chase Freedom Flex and Discover it Cash Back lets you earn more through rotating categories. Amazon Prime Rewards Visa works great for online shopping enthusiasts, and the Capital One Savor is perfect if you love dining out.

Annual fees shouldn’t scare you away. These cards’ boosted reward rates and extra perks are worth the cost. The Wells Fargo Active Cash keeps things simple with a flat 2% rate. The U.S. Bank Cash+ and Citi Custom Cash give you the freedom to pick your reward categories.

You should match a card’s rewards to where you spend the most money. A smart strategy might be to use multiple cards – specialized ones for bonus categories and a flat-rate card for everything else. This approach helps you earn the most cash back on all your purchases.

FAQs

Q1. What is the highest cash-back rate currently offered by credit cards?

The highest cashback rate currently available is 6%, offered by the Blue Cash Preferred Card from American Express on purchases at U.S. supermarkets (up to $6,000 per year).

Q2. Are there credit cards that offer 5% cash back?

Yes, several cards offer 5% cash back in specific categories. For example, the Citi Custom Cash Card provides 5% cash back on your top spending category each billing cycle (up to $500), while the Chase Freedom Flex and Discover it Cash Back offer 5% in rotating quarterly categories.

Q3. How do cash-back credit cards with no annual fee compare to those with fees?

No-annual-fee cards like the Wells Fargo Active Cash offer solid flat-rate rewards (2% on everything), while cards with annual fees often provide higher rates in specific categories and additional perks that can offset the cost for frequent users.

Q4. Can you customize cash back categories on any credit cards?

Yes, some cards allow category customization. The U.S. Bank Cash+ Visa Signature Card lets you choose two 5% cash back categories each quarter from a list of options, allowing you to tailor rewards to your spending habits.

Q5. How do credit card companies determine cash-back percentages for different spending categories?

Credit card issuers typically offer higher cash-back percentages in categories where they’ve negotiated better interchange fees with merchants or in areas where they want to incentivize spending. Common high-reward categories include groceries, dining, and gas stations.