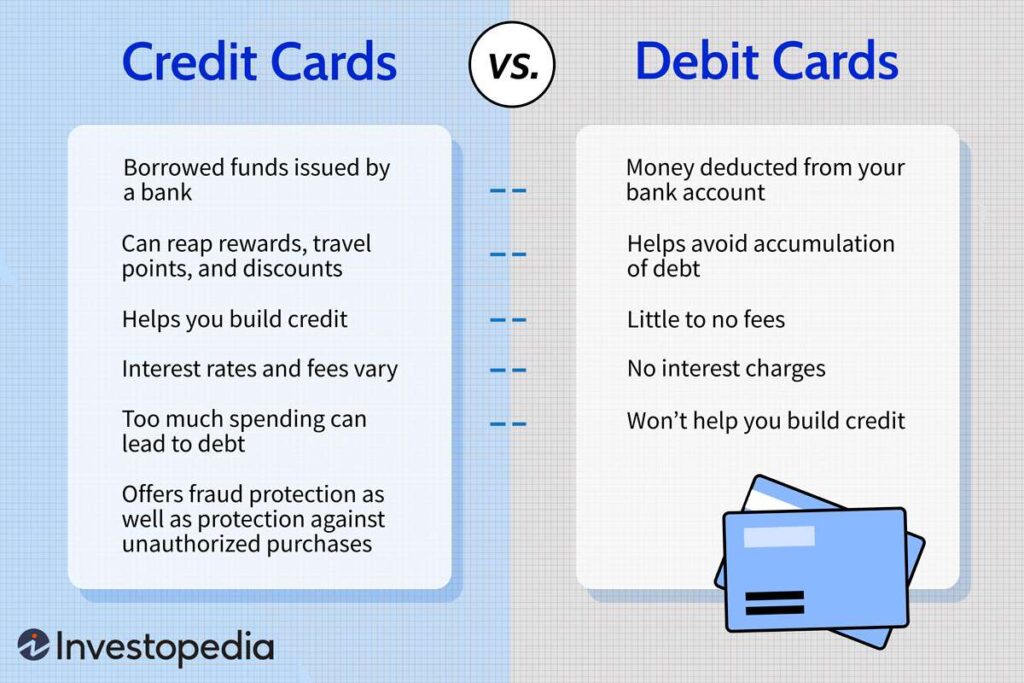

Credit card debt haunts the average American household with nearly $8,000 each year. Debit cards provide a smarter way to handle your money without piling up debt, even though credit cards might seem convenient.

Experts predict checks will completely disappear by 2026 as payment methods continue to evolve. Modern debit cards now come with advanced microchip technology that makes counterfeiting almost impossible and lets you access your money right away.

After looking at Credit Cards’ newest features and perks, I can’t wait to show you how they can improve your spending habits. We’ll look at 10 practical benefits – from immediate expense tracking to zero annual fees. These benefits make Credit Cards a crucial tool to manage money wisely in 2025.

Instant Access to Digital Banking

Digital banking has altered the way people manage their money. 73% of Australian online adults, 68% in the UK, and 65% in the US now expect to handle all their financial tasks through mobile apps.

Digital Banking Features in 2025

Modern Credit Cards naturally connect with digital banking platforms and give users unprecedented control over their daily transactions. These platforms let users access their funds through cloud-based payment systems that work on multiple devices. Users can also manage multiple virtual cards under a single account, which works great for controlling business or family expenses.

Mobile App Integration

Debit cards‘ integration with mobile payment apps has made transactions more convenient. These apps create secure connections between your Credit Card and existing bank accounts by using encrypted electronic keys for safe transactions. The mobile integration supports both iOS and Android platforms, so it ensures wide accessibility. Some key features include:

- Contactless payments through smartphones and smartwatches

- Digital wallet compatibility with Apple Pay and Google Pay

- Instant virtual card generation for online purchases

Real-time Transaction Alerts

Transaction monitoring has become more sophisticated with live alerts that help identify potential fraud. Users can customize notifications based on specific criteria, including:

- Transaction amount thresholds

- Location-based alerts

- Account balance updates

Users receive these alerts via SMS or email right when their card is used. Banks also provide liability protection policies that protect against unauthorized transactions, which makes Credit Cards an increasingly secure payment option.

Enhanced Security Features

Modern Credit Cards use advanced security measures that protect your money with multiple layers of defense. These security features work together to create a strong shield against unauthorized access and fraud.

Chip Technology Advancements

EMV chip technology is the life-blood of Credit Card security. It creates a unique one-time code for every in-store transaction. This technology has shown amazing results – fraud rates dropped by 75% at stores using chip-enabled terminals. Each transaction needs a new security code, which makes fake cards useless.

Fraud Protection Systems

Banks now use artificial intelligence with live monitoring to keep your transactions safe. Their systems look at several things together:

- Transaction patterns and unusual activity

- Geographic location monitoring

- Purchase amount thresholds

- Live transaction verification

- Behavioral biometrics tracking

Banks also use point-to-point encryption (P2PE) to protect data before it reaches the store. This encryption stays secure until it reaches special hardware modules outside the store’s system.

Zero Liability Guarantees

Zero liability policies give you complete protection against unauthorized transactions. Federal regulations limit your liability to $50 if you report fraud within two business days. Most major banks go further and offer full coverage with zero liability policies that are a big deal as it means that they exceed federal requirements.

You need to do these things to stay protected:

- Report lost or stolen cards quickly

- Take care to protect your card information

- Help with fraud investigations when needed

Your protection depends on how fast you report issues. Reporting within 60 days of getting your statement will give a maximum coverage. Mastercard and Visa process refunds for unauthorized transactions within five business days after you tell them.

Zero Interest Payments

Using Credit Cards instead of credit cards can save you money through zero interest and lower fees. Debit cards pull money directly from your bank account, so you won’t rack up interest charges like credit card users often do.

Cost Savings vs Credit Cards

A USD 100 grocery purchase costs merchants USD 2.07 in credit card fees because of high interchange rates. The same purchase with a Credit Card costs just USD 0.30. Debit card fees average USD 0.34, or 0.73% of the purchase amount. These lower costs often mean better prices for customers.

No Hidden Charges

Today’s Credit Cards stand out with their clear fee structure. Most big banks now give you accounts with:

- No monthly maintenance fees

- No minimum balance requirements

- No overdraft charges

- No ATM withdrawal fees

- No replacement card fees

Banks used to charge various fees, but the industry has moved toward customer-friendly policies. This change helps you avoid unexpected charges that come with credit cards.

Fee Structure Explained

The Federal Reserve sets strict rules for debit card fees. Banks with assets over USD 10 billion can’t charge more than 0.05% plus 21 cents per transaction. Merchants pay lower fees for in-store purchases than online ones because security measures like PIN verification make transactions safer.

Card processors use two main pricing models. Flat-rate processors charge about 2.6% plus 10 cents for in-person transactions, whatever the card type. Interchange-plus processors pass through the actual interchange rates with a fixed markup, which makes debit transactions cheaper for businesses.

Cashback and Rewards

Debit cards now come with amazing cash back rewards. Some programs give back up to 10% on purchases from specific merchants. These rewards help cardholders get more value from their daily spending without credit card risks.

2025 Reward Programs

Banks have rolled out reward structures that focus on percentage-based returns. You can get 1% cash back on monthly purchases up to USD 3,000 with Discover’s program. Axos Bank gives 1% back when you use signature-based transactions, capped at USD 2,000 monthly. Some programs even boost rates to 2-5% when you spend on subscriptions, food delivery, and rideshare services.

Points System Overview

Banks structure their point systems differently. Most give one point for each dollar spent on qualifying purchases. Points convert smoothly into various rewards, and certain categories earn bonus points. To cite an instance, see the Bold Debit Card – it gives 1 Bold Point for every USD 2.00 spent on eligible purchases. Modern point programs have become more customer-friendly with no expiration dates and flexible redemption options.

Redemption Options

Today’s debit cards let you redeem rewards in many valuable ways. Here’s what you can get:

- Direct deposits into checking accounts

- Travel purchases and airline miles

- Gift cards from partner merchants

- Merchandise from reward catalogs

- Investment options through stock-back programs

Reward redemptions typically process within five business days. The process is straightforward and user-friendly. All the same, some cards need minimum redemption amounts or specific requirements. You might need to maintain a minimum balance of USD 1,500 to qualify for full reward rates.

ATM Network Benefits

Getting cash remains a vital debit card benefit. Banks maintain large ATM networks worldwide. Currently, there are over 2 million ATM locations around the world where you can get your money.

Global ATM Access

Major banks have built strong ATM networks that cover multiple continents. These networks handle millions of transactions every day through mutually beneficial alliances like the Global ATM Alliance. Leading banks now offer access to more than 70,000 fee-free ATMs nationwide. You’ll find them in popular retail stores like Target, Walgreens, and CVS.

Fee-free Withdrawals

The financial world has moved toward customer-friendly ATM policies. Many banks now offer detailed fee reimbursement programs to eliminate withdrawal costs. The average total ATM fee is USD 4.77. Several banks provide ways to avoid these charges:

- Complete reimbursement for worldwide ATM fees

- Access to surcharge-free networks with 60,000+ locations

- Zero foreign transaction fees for international withdrawals

ATM Locator Features

Modern banking apps come with smart ATM locator tools. These tools help you find the nearest fee-free ATM both at home and abroad. The locator tools merge naturally with mobile banking apps. They show immediate information about ATM availability and services.

Banks have improved ATM functions beyond simple cash withdrawals. Modern ATMs support various transactions. 39% offer expanded self-service options while 29% maintain a vital physical presence in local communities. ATM screens have become more interactive and user-friendly. They provide smooth, available, and quick customer experiences.

International travelers find ATM withdrawals more cost-effective than traditional currency exchange services. Wide availability and better security measures make ATMs safer than carrying large amounts of cash, especially when you travel abroad.

Digital Wallet Integration

Digital wallets have revolutionized debit card functionality. 50% of online transactions and 30% of in-store purchases now go through these platforms. These numbers will likely reach 61% and 46% by 2027.

Mobile Payment Options

Modern debit cards combine smoothly with major digital payment platforms. We added cards to Apple Pay, Google Pay, or Samsung Pay to enable transactions through smartphones and smartwatches. Cardholders can make purchases without their physical cards because these platforms process transactions through secure digital tokens.

Contactless Payment Features

Tap-to-pay technology makes payments quick and simple. 80% of all in-person Visa transactions happen at contactless-enabled merchants. The process works like this:

- Unlock your device

- Hold it near the payment terminal

- Authenticate through biometric data or PIN

This technology will spread beyond retail stores. Many transit systems already accept contactless payments for fares.

Digital Wallet Security

Digital wallets use multiple protection layers to keep transactions safe. These platforms will soon become complete systems that bring together payments, identity, and loyalty programs. The security framework has:

- Tokenization that replaces actual card numbers with unique digital identifiers

- Biometric authentication through fingerprint or facial recognition

- Encryption of all transaction data

- Zero liability protection against unauthorized transactions

The security technology works well. Young people now prefer digital wallets over traditional payment methods. Digital wallets also stay isolated from other phone applications. This prevents malware from accessing financial information. This integrated security makes digital wallet integration a valuable benefit for modern consumers who use debit cards.

Automated Bill Payments

Automated bill payments are a great way to get debit card benefits. They remove the stress of payment deadlines and help cardholders build strong vendor relationships without late fees.

Setting Up Auto-pay

We provided our debit card information to companies that send monthly bills. Cardholders should verify the company’s legitimacy and review authorization terms. The setup process has these steps:

- Selecting payment amounts and frequency

- Choosing payment dates

- Confirming account details

- Setting up payment alerts

Payment Scheduling

Payment scheduling lets you choose flexible timing and frequency options. Cardholders can pick standard delivery dates or create custom schedules based on their priorities. The system processes payments through the Automated Clearing House (ACH) network to ensure reliable transfers.

You can schedule payments for:

- Fixed monthly amounts

- Variable bills within specified ranges

- One-time payments

- Recurring subscriptions

Payment Tracking

The tracking system gives you complete visibility into payment status and history. The platform keeps detailed records of all scheduled transactions and provides immediate updates on payment processing.

Payment monitoring has advanced features like automatic reconciliation within accounting software and detailed transaction histories up to 36 months. You’ll receive notifications about:

- Upcoming scheduled payments

- Successful transactions

- Failed payment attempts

- Payment amount changes

Banks must alert cardholders at least 10 days before processing any payment that is different from the authorized amount. This transparency and detailed tracking make automated bill payments through debit cards a reliable way to manage regular expenses.

International Usage Benefits

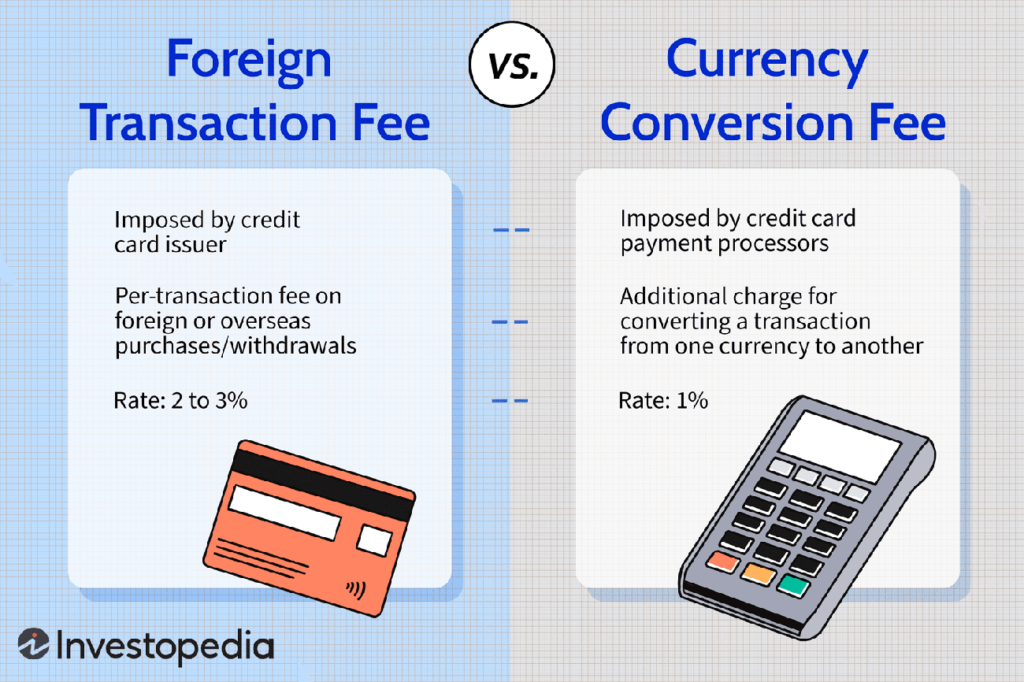

Debit cards make traveling abroad easier than ever before. This convenience comes from better international banking networks and security features. Most banks charge between 1% to 3% for foreign transactions, but you can find cards that don’t charge any international fees.

Foreign Transaction Features

Debit cards make spending money overseas simple and hassle-free. Banks like Capital One and Discover don’t charge any foreign transaction fees. These cards process international purchases through Visa or Mastercard networks, which charge a basic 1% fee to convert currency. Your bank might cover this cost or add their own markup, which can lead to total fees of up to 3%.

Currency Conversion Rates

Each card issuer handles exchange rates differently. Visa and Mastercard base their rates on wholesale market rates or government-set rates from the previous day. The final conversion rates depend on:

- Network rates when authorizing transactions

- Your bank’s conversion rules

- Local merchant conversion choices

- Time taken to process

Travel Security Measures

You just need strong security measures to protect your money when traveling internationally. Let your bank know before you leave to avoid automatic blocks on your card. Your transactions stay safe through these security features:

- Immediate fraud monitoring systems

- Location-based transaction checks

- PIN rules for international ATMs

- Quick transaction freezing options

Banks suggest keeping emergency contact numbers in a separate place from your cards to stay safe. They can handle unauthorized transaction claims within five business days. You can add extra security by staying away from public Wi-Fi for banking and checking ATMs for suspicious devices.

New cards come with advanced features like RFID-blocking technology that stops electronic theft. Digital wallets also make international transactions safer than regular card swipes by using tokenization.

Merchant Acceptance

Debit cards rule today’s payment world. Merchants processed over 624.86 billion purchase transactions worldwide in 2022. The largest acceptance network covers 180 countries, including more than 55 million merchants and about 2.9 million ATMs.

Global Acceptance Network

Payment networks shape how merchants accept payments today. Visa leads the way in global purchase transactions. UnionPay’s network reaches across 180 countries with over 55 million merchant locations. These networks handle several types of transactions:

- Credit and debit card payments

- Mobile wallet transactions

- Contactless payments

- Digital currency transfers

- International purchases

Online Shopping Features

Small businesses have embraced debit cards, with 96% using them as their main payment method. Merchants protect customer data during online transactions through end-to-end encryption and tokenization technology. Security measures include PCI-compliant systems and up-to-the-minute fraud detection.

POS Terminal Compatibility

90% of merchants now accept digital wallets through modern Point-of-Sale systems. The latest POS terminals come with:

Advanced features help merchants process payments through multiple channels, including mobile devices and contactless readers. These terminals work with many payment types. Small businesses process 65% of their annual sales revenue through merchant services. Cash App Pay and Venmo continue to grow, with merchant acceptance rising by 8 percentage points.

Debit payments offer lower processing fees than credit cards, which helps merchants save money. Tokenization and contactless payment features make transactions safer for everyone involved.

Conclusion

Debit cards are powerful financial tools that offer the most important advantages over traditional credit cards. These cards give you direct access to your funds without debt or interest charges. They keep your money safe with EMV chips and up-to-the-minute monitoring.

You can track every dollar you spend with smart budgeting features. The cashback rewards add extra value to your daily purchases. On top of that, wide ATM networks and merchant acceptance in 180 countries make these cards perfect for local and international use.

The digital world of debit cards looks bright. Advanced digital wallet integration and automated bill payments will make financial management easier. These new ideas, plus zero interest payments and detailed security measures, make debit cards vital tools for smart money management in 2025 and beyond.

A switch to debit cards can reshape your spending habits while keeping your money secure and debt-free. The mix of instant access, better security, and practical benefits gives you a unique banking experience where you stay in control of your money.

FAQs

1. What are the main advantages of using a debit card instead of cash?

Debit cards provide convenience, security, and easy tracking of expenses. They eliminate the need to carry large amounts of cash and allow for safer transactions.

2. Is a debit card safer than carrying cash?

Yes, debit cards are safer because they can be blocked if lost or stolen. Unlike cash, which cannot be recovered, debit cards offer fraud protection and secure PIN-based transactions.

3. Can I use my debit card for online purchases?

Absolutely! Debit cards are widely accepted for online shopping, offering a secure and convenient way to pay without needing a credit card.

4. Do debit cards have any hidden fees?

Most debit cards have minimal or no fees for transactions. However, some banks may charge fees for ATM withdrawals outside their network, so it’s good to check with your bank.

5. How do debit cards help with budgeting?

Debit cards only allow you to spend what’s available in your account, preventing overspending and helping you stick to your budget more effectively compared to credit cards.