Cancel Discover Card refers to the process of terminating a Discover credit card account. To do this, cardholders need to contact customer service, confirm their account details, and request the cancellation of their card. It’s important to settle any outstanding balance before finalizing the closure.

Need to cancel your Discover Card but feeling unsure about the process? Don’t worry, it’s simpler than you might expect! Whether you’re switching to a new card or just cutting down on spending, cancelling can be quick and painless. In just a few steps, you’ll have your Discover Card canceled without any trouble. Let’s guide you through it!

To cancel your Discover Card, start by contacting customer service through the number on the back of your card. Have your account details ready to verify your identity. Ensure your card’s balance is fully paid off to avoid complications. Once everything’s clear, the representative will assist you with the cancellation process. It only takes a few minutes to close the account!

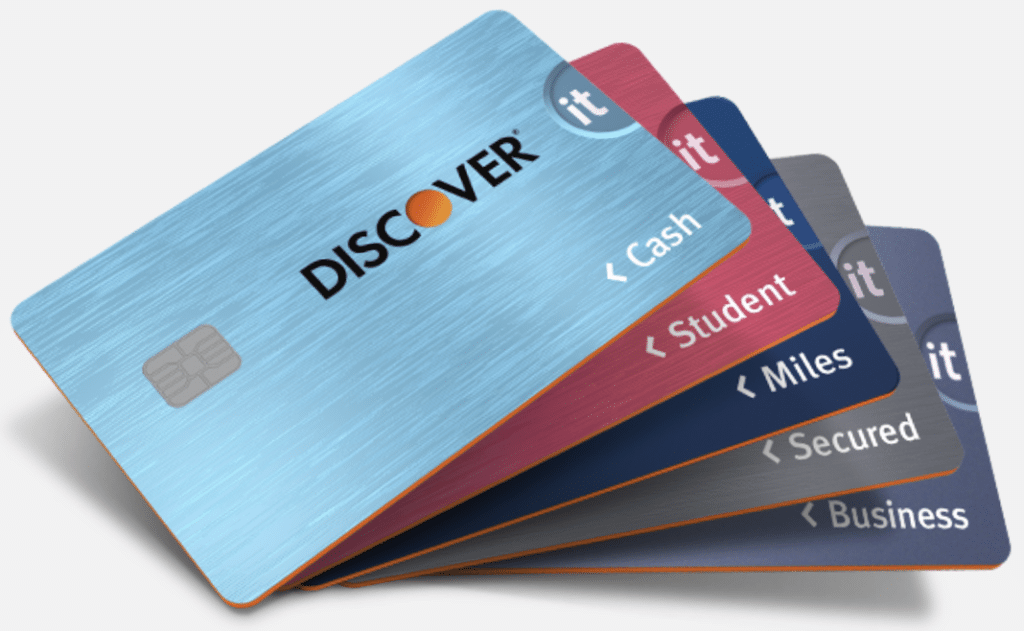

What Are Discover Cards?

Discover cards are credit cards issued by Discover Financial Services, launched in 1985. They are widely accepted across the U.S., allowing users to make purchases with ease. One of their standout features is the ability to earn cashback rewards on everyday purchases. These rewards can be redeemed for statement credits, gift cards, or direct deposits. Discover is also known for offering no annual fees, making their cards attractive to many consumers.

Some of the key features of Discover cards include fraud protection and the ability to access your FICO credit score for free. Discover provides strong customer support, often ranked highly for their service. The cards also offer various perks like 0% intro APR on balance transfers and purchases for a limited time. Additionally, Discover cards work globally, although acceptance outside the U.S. may be more limited. The company continues to innovate and offer new benefits for cardholders.

Types of Discover Cards

Discover offers several variations, catering to different financial needs:

- Discover it® Cash Back Card: Offers 5% cash back on select categories and 1% on other purchases.

- Discover it® Student Cash Back: Tailored for students, with cash-back offers and no annual fees.

- Discover it® Secured Credit Card: Designed to help build or rebuild credit.

- Discover it® Chrome: 2% cash back on gas stations and restaurants, plus 1% on other purchases.

Each of these cards comes with benefits like free FICO credit score monitoring, fraud protection, and access to Discover’s 24/7 customer service.

Things To Know Before Canceling Your Discover Card

Before you take the plunge and cancel your Discover card, there are important factors to weigh. Canceling a credit card can have an impact on your credit score, and depending on your personal financial situation, this impact could be negative. Here are some considerations to keep in mind:

1. Impact on Your Credit Score

Canceling a credit card affects two main components of your credit score:

Credit utilization ratio and length of credit history.

- Credit Utilization Ratio: This refers to how much credit you’re using compared to your total available credit. Canceling a card reduces your available credit, which can raise your credit utilization rate—a factor that makes up about 30% of your credit score.

- Length of Credit History: The age of your credit accounts contributes to 15% of your credit score. Closing an account with a long history could shorten the average age of your accounts and lower your score.

Pro Tip: If you’re concerned about your credit score, consider keeping the account open but using it sparingly.

2. Rewards and Points

Do you have cash-back rewards or other points accumulated on your Discover card? Be sure to redeem or transfer them before canceling. Once your account is closed, you will likely forfeit any remaining rewards or points. Make sure you know the rules surrounding your card’s reward system to avoid losing out.

3. Outstanding Balances

You cannot cancel a credit card with an outstanding balance. Be sure to pay off any balance in full before proceeding with the cancellation. Interest and late fees may still accrue if you try to close the account with an unpaid balance.

4. Recurring Charges

If you’ve set up any automatic payments or recurring charges on your Discover card (e.g., streaming services, gym memberships), you’ll need to switch these to another card. Otherwise, you risk missing payments, leading to potential service interruptions or even penalties.

Can I Cancel My Discover Card Anytime?

Yes, you can cancel your Discover card at any time. However, there are several optimal times to consider before taking this step. For instance, if you are planning a large purchase or anticipating a life event where your credit score matters (such as applying for a mortgage or a car loan), it’s best to delay the cancellation. Your credit score could temporarily dip due to the reduction in available credit or the effect on your credit history.

On the other hand, if you’ve paid off all balances and redeemed rewards, there’s no harm in moving forward with the cancellation at your convenience.

How To Cancel Discover Cards?

Now that you’ve considered the necessary factors, it’s time to explore the steps to actually cancel your Discover card.

There are three primary methods to close your Discover account:

1. Cancel Discover Card by Calling

One of the easiest and fastest ways to cancel your Discover card is by calling their customer service.

Follow these steps:

- Gather Information: Before calling, have your Discover card and account number handy. Also, jot down any specific questions or concerns you might want to raise with the representative.

- Call Discover: Reach out to Discover customer service at 1-800-DISCOVER (1-800-347-2683). Their customer service is available 24/7.

- Request Cancellation: Once connected, inform the representative that you’d like to cancel your card. Be ready to answer any questions they might have regarding your reason for canceling.

- Confirm Cancellation: Ask for written confirmation (email or mail) that your account has been closed.

Important: Customer service might offer you incentives, such as lower APR or rewards, to encourage you to keep the card open. If you’re certain about canceling, politely decline.

2. Cancel Discover Card By Mail

If you prefer handling the cancellation in writing, Discover allows you to close your account by mailing a cancellation request.

Here’s how you do it:

- Write a Letter: In your letter, include your name, account number, and a statement requesting the cancellation of your account.

- Mail It To: Send the letter to:

Discover Financial Services

P.O. Box 30943

Salt Lake City, UT 84130

Make sure to use certified mail or another trackable service for added security. - Wait for Confirmation: Discover will mail you a confirmation once your card has been canceled.

Note: This method is slower than calling or canceling online, but it’s an option if you prefer paper trails.

3. How To Close Discover Account Online

While Discover doesn’t offer a direct option to cancel a card entirely through their website, you can submit a secure message requesting cancellation.

Here’s what you need to do:

- Log into Your Discover Account: Visit the Discover website or use the Discover mobile app.

- Navigate to Secure Messaging: Use the messaging function to contact customer support.

- Request Cancellation: In your message, ask them to close your account and include your account details.

- Receive Confirmation: Discover will send you a confirmation message once your request has been processed.

How To Freeze Your Discover Card

Not quite ready to cancel your Discover card but want to stop using it temporarily? You can use the Freeze It feature, which prevents new purchases, cash advances, and balance transfers without canceling the account. This can be a smart way to temporarily stop using the card while you decide if you want to cancel it permanently.

Steps to Freeze Your Discover Card:

- Log into Your Discover Account: Visit their website or app.

- Go to Card Management: Under your account options, you’ll see the Freeze It feature.

- Activate Freeze It: Toggle the freeze option, which will halt transactions on your card immediately.

- Unfreeze Anytime: When you’re ready to use the card again, simply log back into your account and unfreeze the card.

This feature is particularly useful for times when you may have misplaced your card but aren’t sure if it’s lost or stolen. It’s a quick way to safeguard your account until you’re ready to either resume using it or take further action.

Alternatives To Discover Card

If you’re canceling your Discover card because you’re looking for better rewards or benefits, there are several credit card alternatives available. Each of these cards offers its own set of perks, so you can choose one based on your spending habits and financial goals.

1. Target Red Card

For frequent shoppers at Target, the Target Red Card offers a 5% discount on all purchases made at Target. The card comes with no annual fees and includes free two-day shipping on eligible items purchased on Target.com. It’s an ideal option for individuals who regularly shop at Target and want to save on everyday purchases.

2. Blue Cash Everyday Card from American Express

This card is a solid option for those who prefer to earn cash-back rewards on everyday purchases. It offers 3% cash back at US supermarkets, 2% at gas stations and select department stores, and 1% on other purchases. There is no annual fee, and you can take advantage of introductory APR offers for the first few months.

3. Walmart Rewards Mastercard

For shoppers who frequently visit Walmart, the Walmart Rewards Mastercard is another great choice. It offers 5% cash back on Walmart.com purchases, 2% at Walmart stores, and 2% at gas stations. Like the Target Red Card, this option is perfect for regular Walmart customers looking to save on everyday shopping.

4. Amazon Prime Rewards Visa Signature Card

This card offers impressive rewards for Amazon Prime members, with 5% cash back on Amazon.com and Whole Foods purchases, 2% back at restaurants, gas stations, and drugstores, and 1% back on other purchases. If you’re an Amazon regular, this card is an excellent choice for maximizing savings.

5. Capital One Quicksilver Cash Rewards Credit Card

For those who prefer simplicity in their rewards program, the Capital One Quicksilver Cash Rewards Credit Card offers a flat 1.5% cash back on all purchases with no limit. There’s no annual fee, and you can take advantage of introductory APR offers on purchases and balance transfers.

Final Thoughts

Canceling a Discover card is an easy process, but it requires a few steps. First, you’ll need to contact Discover’s customer service by phone. The number can be found on your card or on their official website. Once connected, tell the representative that you want to cancel your card. They’ll ask for some basic details to verify your identity. After that, they will guide you through the cancellation process.

Before proceeding, make sure you’ve paid off any remaining balance on your card. Discover will not allow you to cancel if there’s still money owed. It’s also a good idea to redeem any cashback rewards or points you’ve accumulated. Once your balance is cleared, you’re ready to finalize the cancellation. Be sure to ask the representative if there are any final steps needed from your side.

After canceling, it’s wise to check your credit report to ensure the account is marked as closed. This will help avoid any negative impact on your credit score. You should receive a confirmation from Discover, either through email or by mail. Keep that confirmation for your records. If you have any other Discover accounts, like savings or checking, make sure they remain unaffected.

Frequently Asked Questions (FAQ’s)

Does canceling my Discover card hurt my credit score?

Yes, canceling your Discover card can impact your credit score, especially if the card has a long history or makes up a significant portion of your available credit. It can affect both your credit utilization ratio and the average age of your accounts, so it’s wise to consider these factors before canceling.

Will I lose my rewards if I cancel my Discover card?

Yes, any unredeemed rewards will be forfeited once you cancel your Discover card. Make sure to redeem any available cash-back rewards or points before closing the account.

Can I reopen my Discover card after canceling?

No, once you cancel your Discover card, the account is permanently closed. If you wish to use Discover services again, you will need to apply for a new card.

Can I cancel my Discover card if I still have a balance?

No, you must pay off your entire balance before canceling the card. Credit card issuers require that any outstanding balance be settled before the account can be closed.

Can I cancel a joint Discover card account?

Yes, either cardholder can cancel a joint Discover card account. However, both parties should be informed about the cancellation, and any outstanding balance must be cleared before proceeding with the closure.

Salikh Korgay is the author behind Cyber Rised, a blog dedicated to exploring the latest trends in technology and cybersecurity. With a passion for breaking down complex tech topics, Salikh provides readers with practical guides and insightful commentary to help them navigate the digital world. From tech enthusiasts to professionals, Salikh’s writing empowers audiences to stay informed and secure in the fast-evolving cyber landscape.